SOLD BY ALLIED

ASKING PRICE: OIEO £22M

FULHAM TOWN HALL, FULHAM, LONDON, SW6

A stunning 60,000 sq.ft. freehold former town hall sold to a client of Allied Property and exchanged within 4 days from inspection (and within 48 hours from receipt of documentation). Allied Property Investments were instructed directly by the vendor to market the property which was eventually sold to our client on an unconditional basis. Although the building currently has a Sui Generis use and is Grade ll listed our client is confident they will eventually gain planning for a hotel / hostel / co-working / co-living concept with bars and restaurants etc.

Allied property have many buyers for unconditional deals. In these types of transactions our clients use 100% cash funds for purchase and are often able to pay more than the existing value in the hope of achieving future gains. We constantly seek unconditional deals throughout the UK for future residential / commercial / student and hotel development.

ACQUIRED FOR CLIENTS

ASKING PRICE: £11.7M

VICARAGE ROAD, WATFORD, HERTFORDSHIRE, WD18

Allied acquired an unbroken newly developed (new build) block of 36 flats plus 3 commercial units offering existing income and profitable break up for our client in this instance who is holding the asset for long term income.

Allied Property are incredibly active in the acquisition and disposal of entire Freehold blocks of flats and new developments throughout the UK. We have transacted over 6,000 units in block sales and are always searching for both new and old blocks.

SOLD BY ALLIED

ASKING PRICE: £12M

MIDLAND ROAD, BEDFORDSHIRE, LUTON, LU2

Allied Property are proud to announce the completion of a substantial development site measuring 2.34 acres (0.947 hectares) with planning permission for a regeneration scheme comprising 350 apartments arranged over 7 blocks, together with retail and leisure use spaces. The site was sold by Allied to one of the UK’s largest property companies who will develop and hold the scheme for long term income.

Allied Property have close and long established relationships with both private and institutional UK and overseas developers who are searching for similar large Residential regeneration opportunities with or without planning permission in place. In this instance, Allied Property are also pleased to have produced their first CGI Video to aid in the disposal of the Luton site which proved to be a great marketing tool.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: £30M

BIRMINGHAM

c. £30M of senior funding / equity arranged for substantial residential development

Allied Property regularly arranges cross-funding deals between clients to provide senior, junior, equity or mezz funding to facilitate other client’s purchases or developments.

SOLD BY ALLIED

ASKING PRICE: £12M

THE QUARTERS, ST ALBANS ROAD, WATFORD, WD17

A former 100 bed hotel with an adjoining multi-storey car park sold by Allied Property for future development into a 500 bed co-living scheme. The hotel was originally purchased by an Allied Property client back in 2014. The hotel was subsequently converted to a ‘long stay’ operation and has enjoyed near 100% occupancy near since together with its banqueting and retail spaces. Now 10 years later we are proud to have resold the hotel to another client of Allied Property on an unconditional bases for its future development into a co-living building.

Allied Property are extremely active in the co-living space having been involved in numerous similar transactions throughout the UK in major cities. We have active clients who are seeking well located, large hotels (minimum 100 beds up to 600 beds or more) for conversion and redevelopment into modern co-living schemes. We are also interested in sites or hostels for the same use.

ACQUIRED FOR CLIENTS

ASKING PRICE: £6.5M

GUNNERSBURY MEWS, CHISWICK, WEST LONDON, W4

A secure gated residential development located just south of Chiswick High Road. Allied Property introduced the asset to one of our Family Office clients who purchased the 9 remaining town houses from a mortgagee in possession. Our client in this instance is holding the houses for long term income and is extremely pleased with the introduction we made to this opportunity and the residual value they were able to purchase at.

Allied Property are networked into numerous deal sources including many on behalf of mortgagees in possession.

SOLD BY ALLIED

ASKING PRICE: £42M

ENGLANDS LANE, HAMPSTEAD, LONDON NW3

A substantial property comprising 165 flats totalling 36,734sq.ft. freehold sold at £42,000,000 by Allied Property to a substantial European family trust. The deal was seen and completed within 3 weeks and brokered entirely by Allied Property Investments (London) Ltd. The building is being held by the purchaser for long term income stream.

We are actively looking for similar properties on behalf of this client. The client is a family trust which owns in excess of 68,000 apartments for rental income. They require self-contained accommodation only, either residential, hostel or HMO but must be entire, unbroken blocks (20 – 300 units) anywhere within the M25, for long term income purposes.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: €51M

PARIS, FRANCE

Cross-client funding deal raising €51,000,000 to facilitate development of c.600 homes and luxury hotel.

Allied Property regularly arranges cross-funding deals between clients to provide senior, junior, equity or mezz funding to facilitate other client’s purchases or developments.

ACQUIRED FOR CLIENTS

ASKING PRICE: £4.6M

QUEEN’S ELM PARADE, FULHAM ROAD, LONDON, SW3

A rare unbroken freehold investment, held in the same family ownership for over 100 years. Our client purchased a parade of shops with an entire block of apartments above. This was an exciting and iconic purchase for our client who will hold the asset for future income.

The client in question is looking to purchase further freehold shop and upper parts, for wealth preservation and has completed purchases via Allied Property in: Primrose Hill (x2), Hampstead Village (x3), Notting Hill (x4), Queens Park, Fulham and Belgravia.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

WHITE HART LANE, TOTTENHAM, N17

Site sold with planning permission in place for 144 units. The site was owned by Tottenham Hotspur FC and purchased by a London based house builder. The development will feature a mixture of 1, 2 and 3 bedroom homes which will benefit from local amenities and leisure facilities including a number of parks and outside spaces with excellent links to transport facilities.

Allied Property have long standing relationships with well-established developers who are ready, willing and able to purchase similar projects with cash funds. With our focused hands on approach we are often able to succeed where other agents fail. Allied deal only with long standing clients who are proven performers with ample cash funds, we do not deal with other agents or third party introducers.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

CURZON STREET, LAWLEY MIDDLEWAY, BIRMINGHAM, B4

Site sold with planning permission in place for a 14 storey Student tower comprising 365 en-suite beds with study hubs, gym, communal and break out areas. The tower is located directly outside the new Birmingham HS2 link and will house students from both Birmingham and Ashton Universities after its completion in 2023.

Allied Property have now successfully transacted over 9,000 Student beds. Student Deals have been sold and acquired in this sector with and without planning permission across the UK as well as existing Student investment deals. We are constantly searching for similar ‘deliverable and valuable’ opportunities in this sector for ready, willing and able clients who are able to transact on an immediate basis.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

PETERBOROUGH, CAMBRIDGESHIRE PE1

An extensive and unbroken residential freehold estate of 74 properties acquired for client for long term rental income.

We are actively looking for similar properties on behalf of this client. They look for broken or unbroken (preferably unbroken) freehold blocks (preferably ex-local authority or secondary locations). The client currently operates approximately 2,000 rental units and is eager for more. This client will purchase throughout the UK with ample cash funds available.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: £44M

WELWYN GARDEN CITY, HERTFORDSHIRE, AL8

£44M “full stack” funding including senior equity and mezz to facilitate a large mixed-use development together with an existing investment to a major UK food retailer.

Allied Property regularly arranges cross-funding deals between clients to provide senior, junior, equity or mezz funding to facilitate other client’s purchases or developments.

ACQUIRED FOR CLIENTS

ASKING PRICE: £2M

PORTOBELLO ROAD, NOTTING HILL, LONDON, W10

A rare, unbroken freehold building which has been in family ownership for several years. The building comprises the former GEORGE’S FISH AND CHIP SHOP together with the residential upper parts comprising TWO FLATS in Notting Hill. The building was purchased vacant to allow for ample asset management and development opportunities. The client intends to retain the building within their portfolio.

The client in question is looking to purchase further freehold shop and upper parts, for wealth preservation and has completed purchases via Allied Property in: Primrose Hill (x2), Hampstead Village (x3), Notting Hill (x4), Queens Park, Fulham and Belgravia.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

HMO PORTFOLIO, CENTRAL LONDON

A Portfolio of 30 buildings comprising 296 HMO units. All of the houses had an HMO use and were let to various tenants including a handful of corporate accommodation providers. The Portfolio produced a very low yield on day one as the purchaser in this instance was able to renegotiate many of the leases to provide housing for homeless and families in crisis with Local Authority Partners and Housing Charities.

Throughout 2020 and 2021 Allied Property have transacted in excess of £250m of similar HMO stock both within the M25 and across the UK. We continue to look for similar buildings with HMO or Hostel use across the UK for substantial ready, willing and able cash purchasers including property companies, funds and social housing REITs with whom we have a very close working relationship.

ACQUIRED BY ALLIED

ASKING PRICE: Undisclosed

FULHAM ROAD, CHELSEA, LONDON, SW6

Purchase of the iconic La Reserve hotel which is directly opposite Fulham Town Hall which was also transacted by Allied Property. La Reserve will now be the subject of an extensive redevelopment and refurbishment programme to create 150 serviced apartments. The apartments will be operated by our client under their own brand and retained for long-term investment purposes.

Allied Property have acquired over 30 Central London hotels. We have mandates to purchase similar opportunities between £5m – £300m either existing or with opportunity to create hotels. We act on behalf of a number of hotel developers, investors and operators who are able to transact on similar opportunities.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

DALSTON, LONDON E8

Entire mixed-use development of 32 flats plus retail and B1 space forward purchased from developer prior to completion of the scheme on behalf of Hong Kong investment fund.

Allied Property have forward purchased over 1,000 units to Middle Eastern & Far Eastern clients. We are now looking across the UK to purchase entire developments within a 10 minute walk of a train station and between 6 – 36 months until practical completion with a minimum of 10 units and maximum 300 units.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: £18.7M investment refinance

CARDIFF, WALES, CF

Refinance arranged for large leisure and hotel investment.

Allied Property can arrange finance and refinance deals “quicker than most” on behalf of clients. Debts sources utilised by Allied are all lending from their own balance sheets on a non-recourse basis.

ACQUIRED FOR CLIENTS

ASKING PRICE: £3.8M

KENSINGTON PARK ROAD, NOTTING HILL, LONDON, W11

A rare, unbroken freehold building comprising MEDITERRANEO CUCINA ITALIANA RESTAURANT together with the residential upper parts comprising TWO FLATS in the heart of Notting Hill offering ample asset management and development opportunities. The building was purchased by a family office client of Allied Property Investments. This is our 10th deal with the same client in the space of 12 months.

The client in question is looking to purchase further freehold shop and upper parts, for wealth preservation and has completed purchases via Allied Property in: Primrose Hill (x2), Hampstead Village (x3), Notting Hill (x4), Queens Park, Fulham and Belgravia.

SOLD BY ALLIED

ASKING PRICE: £2.2M

DERBY ROAD, MATLOCK BATH, DERBYSHIRE, DE4

Stunning and substantial period country estate (c. 25 bedrooms,10 estate rooms plus other) with significant development potential sold by Allied Property as Joint Auctioneers. Centrally located in the Peak District comprising 34 Acres of land and measuring c.27,160 sq.ft/ 2,522 sq.m existing period Stately Home. Historic Planning Permission granted for Care Home (Class C2) and Hotel (C1).

Allied Property work closely with many Auction Houses across the UK. We often advise our clients to capitalise on our relationships with Auction Houses to achieve the greatest value. Using Allied Property as Joint Auctioneer is often more affective than clients working alone with the Auction House as it allows us to use our bespoke marketing and client relationship expertise at no extra cost to the seller.

SOLD BY ALLIED

ASKING PRICE: £4.355M

CHURCH LANE, KINGSBURY, BRENT, NW9

A former express dairy warehouse site which was sold to a private family office. The building was bought completely unconditionally and within 5 days. The warehouse will be retained for long-term investment purposes.

Allied Property are currently transacting on many other unconditional sites within the M25 and are constantly searching for more ‘deliverable and valuable’ brownfield sites. Our clients are well-funded meaning they are able to transact on an immediate basis.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

STRATHMORE GARDENS, KENSINGTON, LONDON, W8

This pretty building sits at the end of an extremely well-respected cul-de-sac in Kensington. The entire building was purchased by a client of Allied Property and was exchanged within 4 days of inspection. The building is arranged as 7 flats, 6 of the flats were vacant and 1 had a regulated tenant in occupation. The property was purchased as an asset management project to create a solid income for the purchasing client of Allied Property.

The purchaser in this instance is very experienced in the Kensington area and more importantly, is willing to buy what others perceive as ‘problem properties’. Allied Property have a number of clients who will take on what others perceive as deal-breaking issues and turn them around to their advantage. If you have any similar properties anywhere in Central London please contact a member of the Allied team.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

HATTON GARDEN, HOLBORN, LONDON EC1

A ‘Site Assembly‘ transaction involving the acquisition of several buildings surrounding a central cleared- site totalling over 1/3 of an acre. Allied Property arranged funding and a ‘blue-chip’ joint-venture partner for our mandated client to acquire the site and take it forward to planning and development. The total scheme produced c.500,0000 sq. ft. of built area including: Residential, Co-Working, Workshop Space, Storage and Parking.

Allied Property constantly arranges funding and joint-venture deals on behalf of clients. These synergies have often resulted in major regeneration projects throughout the UK.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

QUEENS GARDENS, PADDINGTON, LONDON, W2

A Freehold building which had been in the same family ownership for 40 years. The building featured 19 x studios and 4 x 1 bedroom flats. The entire building was in a sad state of repair and was in desperate need of some care and attention. Our client in this instance purchased the building in order to completely refurbish and asset manage the building to create an income stream by letting all of the newly refurbished and reconfigured flats.

This building was purchased by a family office who are extremely active in the Bayswater, Notting Hill and South Kensington markets. The client in this instance has a rolling facility of £50-£60m to purchase similar assets in these locations only. They are predominantly looking for Residential, Commercial or Mixed-Use buildings with asset management opportunities to create income.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

PARKHOUSE STREET, CAMBERWELL, LONDON, SE5

Light industrial site sold unconditionally for planning gain and future development.

We are always looking to purchase sites, land and buildings with and without planning permission / PD for development on behalf of long established ready, willing and able cash purchasers.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

CAMLEY STREET, KINGS CROSS, LONDON, N1

A site sold subject to planning permission for a substantial student accommodation tower of c. 400,000sq.ft. The building has subsequently been developed and is now being operated by the purchaser.

One of our directors has been instrumental in the sourcing and the purchasing of over 5,000 student beds on both an unconditional and conditional basis. We have also transacted completed schemes to UK and Overseas, Private, Corporate and Institutional investors.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: £756K

BALHAM, LONDON, SW12

Cross-client funding deal raising £756,000 to facilitate development of permitted development scheme.

Allied Property regularly arranges cross-funding deals between clients to provide senior, junior, equity or mezz funding to facilitate other client’s purchases or developments.

SOLD BY ALLIED

ASKING PRICE: £35M

HMO PORTFOLIO – M25 CORRIDOR

A portfolio of 44 houses comprising in excess of 275 self-contained studio apartments. All of the units have an HMO use and are let to a variety of local authorities social landlords and various charities. The portfolio produced a very healthy income on day 1 and our client allowed the vendor to become the operator and to continue to manage the portfolio on their behalf.

Allied Property have transacted in excess of £250m of HMO buildings. Transactions have included existing large portfolios as well as the delivery of over 200 new HMO buildings which have been developed for clients by our supply partners. The client in this instance is a European fund who own in excess of 68,000 apartments for rental income. They require self-contained accommodation only, either residential, hostel or HMO but must be entire, unbroken blocks (20 – 300 units) anywhere within the M25, for long term income purposes.

SOLD BY ALLIED

ASKING PRICE: £16M (together with Kensington Suites Hotel)

HOLLAND ROAD, KENSINGTON, LONDON, W14

A 29 bedroom boutique hotel set across 2 period freehold buildings and arranged over 4 floors. The hotel is located close to the Olympia Exhibition Centre and Westfield Shopping Centre. The hotel was purchased together with the Kensington Suites Hotel by clients of Allied Property who will eventually be operating under their own brand.

Since 2018 Allied Property have again become very active in the hotel space. We have recently acquired 4 other hotels (outside of this portfolio) which do not appear on our track record for confidentiality reasons. We have a number of private and institutional hotel investors and developers looking for projects across the UK.

SOLD BY ALLIED

ASKING PRICE: £2.5M

HIGH STREET, SOUTHEND ON SEA, ESSEX, SS1 1JX

Allied Property Investments are delighted to announce the completion of the above-mentioned retail investment. The investment was exchanged within 5 days of viewing to an overseas Family Office who will hold the asset for long term income.

Allied Property are transacting on various commercial investments throughout the UK and are constantly searching for further ‘deliverable and valuable’ opportunities. Most of our clients are cash purchasers and are able to transact on an immediate basis.

SOLD BY ALLIED

ASKING PRICE: £16m (together with Holland Court Hotel)

HOLLAND ROAD, KENSINGTON, LONDON, W14

A 42 bedroom 3* / 4* hotel set in 2 stucco fronted period freehold buildings. The hotel is located close to the Olympia Exhibition Centre and Westfield Shopping Centre. The hotel was purchased together with the Holland Court Hotel by clients of Allied Property who will eventually be operating under their own brand.

Since 2018 Allied Property have again become very active in the hotel space. We have recently acquired 4 other hotels (outside of this portfolio) which do not appear on our track record for confidentiality reasons. We have a number of private and institutional hotel investors and developers looking for projects across the UK.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

HILTON’S WHARF, GREENWICH, LONDON, SE10

Entire development of 64 flats forward purchased from developer prior to completion for Far Eastern clients.

Allied Property have forward purchased over 1,000 units to Middle Eastern & Far Eastern clients. We are now looking across the UK to purchase entire developments within a 10 minute walk of a train station and between 6 – 36 months until practical completion with a minimum of 10 units and maximum 300 units.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

PARK WEST, EDGWARE ROAD, LONDON, W2

Car park sold to one of Europe’s largest self-storage groups. The c.23,412 sq. ft (c.130 space) Car Park was formerly used to store luxury cars on behalf of a private family office. The car park will be repurposed as a self-storage facility in the near future.

Allied Property are currently transacting on further car parks (for alternative uses). We are constantly searching for more ‘deliverable and valuable’ car parks or similar opportunities in the sector for this ready, willing and able client who is able to transact on an immediate basis.

SOLD BY ALLIED

ASKING PRICE: £2.3M

PEMBRIDGE ROAD, NOTTING HILL, LONDON, W11

A prime, end of terrace, unbroken freehold block of flats. The building was sold to a family office who are eagerly searching for further freehold buildings in the immediate area. The currently hold a portfolio in excess of £60m, all buildings are retained for long term income purposes.

Allied are seeking further buildings for the same client and invite suggestions from mandated agents or owners only.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

CORPORATION STREET, ROCHESTER, ME1

Cleared site sold subject to planning permission for a 64 apartment scheme (all private residential). The development will also include approximately 5,000 sq.ft. of commercial at ground floor level, the new build scheme is to be located directly next to Rochester train station.

Allied Property have sold numerous sites with and without planning permission in most regions across the UK. We are constantly looking for sites and buildings for property companies, housing associations and ‘not for profit’ charities. Please contact a member of our team for further information.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: £10.4M senior debt development finance

FALMOUTH, CORNWALL, TR11

Senior debt finance arranged for client in 10 days. The loan will facilitate a development of 28 luxury apartments and houses in one of the most scenic areas of Cornwall’s dramatic coastline.

Allied Property regularly arranges senior debt “quicker than most” on behalf of clients. Debts sources utilised by Allied are all lending from their own balance sheets on a non-recourse basis and can lend up to 90% of costs with interest rates from 6.5%.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: £25.5M senior debt development finance

BETHNAL GREEN, LONDON, E2

Senior debt finance arranged for client in 10 days. The loan will facilitate the development of 56 residential units and a ground floor commercial.

Allied Property regularly arranges senior debt “quicker than most” on behalf of clients. Debts sources utilised by Allied are all lending from their own balance sheets on a non-recourse basis and can lend up to 90% of costs with interest rates from 6.5%.

ACQUIRED FOR CLIENTS

ASKING PRICE: £1.4M

HEATH STREET, HAMPSTEAD, NORTH LONDON, NW3

An unbroken Grade II Listed building in the heart of Hampstead Village acquired by Allied Property with existing income. The commercial element was let to a pizza restaurant and the residential upper parts offered both development and asset management angles. Prior to our involvement there had been a number of abortive transactions and our client acquired the building within 5 days of inspection and completed 5 days later.

We have purchased 16 ‘Posh Shop and Uppers’ for this Family Office client who is still seeking more in Prime Central London locations.

SOLD BY ALLIED

ASKING PRICE: £2M

CANN HALL ROAD, WALTHAM FOREST, LONDON, E11

Allied Property Investments are delighted to announce the completion a block of 5 loft style apartments which were purchased at discount to market value with existing rental income. The building is located within a 15-minute walk to Leytonstone High Road, Wanstead Park and Forest Gate (Overground) Stations.

The purchaser in this instance is very experienced in the East London area and more importantly, is willing to buy what others perceive as ‘problem properties’. Allied Property have a number of clients who will take on what others perceive as deal-breaking issues and turn them around to their advantage. If you have any similar properties please contact a member of the Allied team.

ACQUIRED FOR CLIENTS

ASKING PRICE: £1.2M

PEMBRIDGE ROAD, NOTTING HILL, LONDON, W11

Allied Property Investments are delighted to announce the purchase of the Marsh & Parson’s offices in Notting Hill Gate together with the upper parts. This asset was purchased for a family office prior to auction and was completed within 48 hours of inspection.

The client in question is looking to purchase further freehold shop and upper parts, for wealth preservation and has completed purchases via Allied Property in: Primrose Hill (x2), Hampstead Village (x3), Notting Hill (x4), Queens Park, Fulham and Belgravia.

ACQUIRED FOR CLIENTS

ASKING PRICE: £4M

COPPER TERRACE, HAYLE, CORNWALL, TR27

Site with planning permission for 3 houses and 67 flats in prime Cornwall tourist location. There was an existing dilapidated warehouse measuring 38,750 sq.ft / 3,600 sq.m with planning permission in place for 70 new build dwellings across 5 blocks comprising 2 x 2-bed Houses, 1 x 4-bed House, 10 x 1-bed flats, 57 x 2-bed flats

Allied Property are always seeking sites with and without planning permission across the UK on behalf of qualified ready, willing and able clients.

ACQUIRED FOR CLIENTS

ASKING PRICE: £1.1M

GONDAR GARDENS, WEST HAMPSTEAD, NORTH LONDON, NW6

An unbroken residential building sold by Allied Property Investments comprising self contained flats which offer asset management opportunities and potential for rental growth. This was the 3rd purchase we have made on behalf of this family office client over the past 12 months.

The client in question is looking to purchase many more similar deals under the following criteria: Unbroken residential buildings only. Ideally looking for buildings at discount to market value that offer development or asset management potential. The client will purchase assets between £1M – £15M and is able to offer immediate cash purchase without surveys or valuation.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

FREEHOLD PORTFOLIO, NOTTINGHAM, LEEDS, PLYMOUTH

Allied Property sold the Freeholds of three blocks of flats in the North, West and South of England. This opportunity was unsold by an auction house who attempted to sale. Very shortly after the auction Allied Property were able to find a purchaser and complete the sale for our client.

As a bespoke investment and development consultancy we are often able to assist where the big agencies fail. Our dedicated team of experienced investment and development agents can assist in any property asset class throughout the UK.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

CENTRAL LONDON LOCAL AUTHORITY FLAT INVESTMENT SCHEME

In this instance Allied Property introduced an equity investor to another client who was mandated to purchase and operate units on behalf of a Local Authority. This transaction involved the ‘test’ purchase of 25 flats for the LA as an option to satisfy future housing needs.

Allied Property are diverse in our contacts and approaches to real estate. We are often called in to advise and transact on behalf of Local Authorities to assist with various different tenures.

SOLD BY ALLIED

ASKING PRICE: £1.85M

RIGDEN STREET, TOWER HAMLETS, LONDON, E14 6DJ

Allied Property Investments are delighted to announce the completion of the above-mentioned Freehold Residential Block. The property was purchased on behalf of a UK based prop-co who exchanged within 10 days of their first inspection. The block will be held in their portfolio for income purposes and at the same time they will apply for planning permission to increase the height, massing and thus the number of units.

Allied Property have a number of similar clients looking for sites and buildings across the UK that have either income, development potential or both.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

QUEENS ROW, ELEPHANT & CASTLE, LONDON, SE17

Former warehouse close to Elephant & Castle Underground Station with full planning permission in place to redevelop 9 luxury flats (6 x 1 beds & 3 x 2 beds) with a net saleable area of 6,480 sq. ft.

Allied Property were approached by the vendor who had previously attempted to sell the building via a prominent Mayfair agent who had 3 contracts issued that all failed to exchange. Allied Property Investments (London) Ltd. found a ready, willing and able cash client who did an ‘attended exchange’ within 48 hours of viewing the property. We have many ready, willing and able cash buyers looking for similar projects.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

HOLLYBANK, MUSWELL HILL, LONDON, N10

Former garage site sold with planning permission for a gated development of 6 new build houses with possibility for further planning gain.

We are always looking to purchase sites, land and buildings with and without planning permission for development on behalf of long established clients who are ready, willing and able cash purchasers.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

HAMILTON TERRACE, ST JOHN’S WOOD, LONDON, NW8

Entire building comprising 6 residential flats sold for development to luxury superhome in prime St. John’s Wood location.

Allied property are particularly active in the super prime markets and have acquired many buildings in prime Central London for development into substantial family homes selling between £20M – £100M. We are always looking for similar opportunities for Russian and Middle Eastern clients to cash purchase.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

HMO PORTFOLIO, CROYDON, LONDON, CR0

Portfolio of 5 HMO buildings with income, uplift and development potential.

Allied Property have a number of strong HMO and Hostel buyers who purchase for long term income purposes. We have acquired HMOs and Hostels across most UK boroughs and are eager to find more stock for ready, willing and able cash investors.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

COMPAYNE GARDENS, WEST HAMPSTEAD, LONDON, NW6

A double fronted and detached freehold house arranged as 11 self-contained flats with interesting scope for letting, refurbishment, redevelopment, occupation etc.

Allied Property constantly search for properties with short to mid-term income and long term development potential on behalf of ready, willing and able cash buyers.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

CAMPSHILL ROAD, LEWISHAM, LONDON, SE13

Former Public House and upper parts comprising 6 self-contained residential flats sold within 1 week despite 3 failed attempts by other local agents.

Allied Property constantly search for properties with short to mid-term income and long term development potential on behalf of ready, willing and able cash buyers. Allied Property Investments (London) Ltd. sold the property within 1 week of being instructed after 2 large investment agents failed to sell.

SOLD BY ALLIED

ASKING PRICE: £13M

TADEMA ROAD, CHELSEA, LONDON, SW10

Entire gated Mews. Forward-purchased on behalf of Middle Eastern fund.

Allied Property have a number of private and institutional clients whose model is to forward purchase entire developments immediately after planning permission is granted. This model totally de-risks a developers development programme. To date Allied have transacted over 2,000 residential units in this model.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

GREEN LANES, STOKE NEWINGTON, LONDON, N16

Sale of a site with planning permission in place for demolition of the existing building and the development of a new-build block featuring 9 luxury apartments.

Allied Property have long-standing and strong relationships with many family offices throughout the UK and Europe. In each case the clients are cash purchasers who are willing to develop and hold the finished units for long-term investment purposes.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

O’LEARY STREET, WARRINGTON, CHESHIRE, WA2

A 12-storey freehold residential block of 82 flats sold for long term rental income.

We are actively looking for similar properties on behalf of this client. They look for broken or unbroken (preferably unbroken) freehold blocks (preferably ex-local authority or secondary locations). The client currently operates approximately 2,000 rental units and is eager for more. This client will purchase throughout the UK with ample cash funds available.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

JASMINE MEWS, PRIMROSE HILL, LONDON, NW1

Entire social housing element of luxury residential development acquired for housing association client.

Allied Property are advisors to many social housing providers. In zones 1 & 2, one of our clients are able to pay more than any other social housing provider as they are privately funded and therefore not capped by government purchase restrictions which applies to most other social landlords.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

DALBERG ROAD, BRIXTON, LONDON, SW2

0.09 acres site with planning permission in place for 6 residential flats and B1 office space.

We are always looking to purchase sites, land and buildings with and without planning permission / PD for development on behalf of long established ready, willing and able cash purchasers.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

ST ALBANS ROAD, WATFORD, HERTFORDSHIRE, WD17

170 bedroom hotel acquired with vacant possession on behalf of clients for investment and operation.

This freehold hotel was acquired for a hotel client who currently has approximately 2,000 beds. We have many cash buyers across all hotel sectors from dry investment to owner-operators.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

HOMER ROW, MARYLEBONE, LONDON, W1

Building sold with planning permission for new build scheme comprising 6 residential flats plus D2.

This deal was sourced by Allied Property and acquired on behalf of a substantial Middle Eastern family and was exchanged and completed within 10 days. Allied Property are sole advisers to this family who have acquired 2 other projects through us. We are constantly looking for development and investment opportunities on behalf of ready, willing and able cash buyers on an immediate basis.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

CAMBRIDGE HEATH ROAD, HACKNEY, LONDON, E1

Entire development comprising 19 flats forward purchased from developer prior to completion for off-shore clients.

Allied Property have forward purchased over 1,000 units to Middle Eastern & Far Eastern clients. We are now looking across the UK to purchase entire developments within a 10 minute walk of a train station and between 6 – 36 months until practical completion with a minimum of 10 units and maximum 300 units.

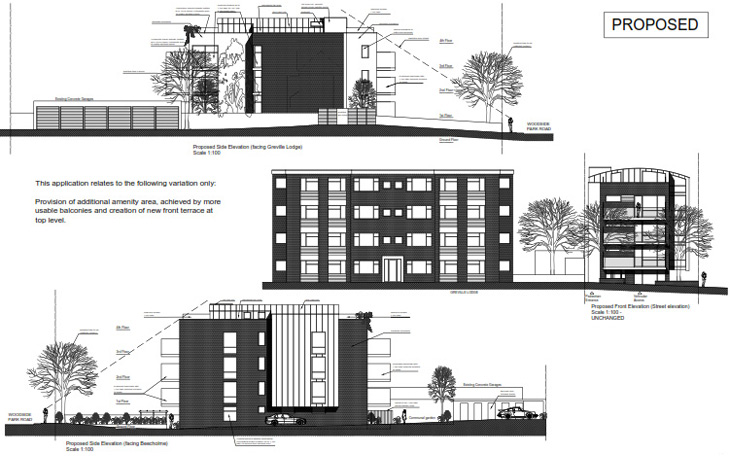

SOLD BY ALLIED

ASKING PRICE: Undisclosed

WOODSIDE PARK ROAD, FINCHLEY, LONDON, N12

Site sold with planning permission for 5 large, luxury apartments purchased for planning gain and future development.

We are always looking to purchase sites, land and buildings with and without planning permission for development on behalf of long established clients who are ready willing and able cash purchasers.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: Undisclosed

EALING, LONDON, W13

Cross-client funding deal raising £6,900,000 of equity to facilitate substantial residential development scheme.

Allied Property regularly arranges cross-funding deals between clients to provide senior, junior, equity or mezz funding to facilitate other client’s purchases or developments.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

HARGREAVES ROAD, AIGBURTH, LEEDS, L17

Allied Property Investments are delighted to announce the completion of a hotel in the above-mentioned location. The client who purchased will be closing the hotel and creating a long lease investment with the Local Authority to house homeless under the local LHA rates.

Allied Property are extremely active across the UK in assets attracting Local Housing Allowance (LHA) rates. We are always looking for HMO’s, hostels, hotels or similar for these type of purchasers and operators.

ACQUIRED FOR CLIENTS

ASKING PRICE: £2.135M

SUMATRA ROAD, WEST HAMPSTEAD, LONDON, NW6

A pair of freehold buildings sold by Allied Property comprising 6 x self-contained studios, 6 x non self-contained bedsits (with kitchenettes) and communal bathrooms (GIA of c.2,200 sq.ft/ 204.4 sq.m). Located within a 5 minute walk from West Hampstead Stations (Thameslink, Overground and Jubilee). The building was sold with an existing income of £120,876 pa and potential to increase to c.£138,000 pa.

Allied Property are retained by many Family Offices/ clients who are incredibly active in purchasing both residential and commercial buildings that offer the opportunity to asset manage and increase the income over the short, medium and long term.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

CHILDERS STREET, DEPTFORD, LONDON, SE8

Vacant freehold Public House acquired unconditionally for property company to gain planning permission and develop into residential scheme.

We are always looking to purchase sites, land and buildings with and without planning permission for development on behalf of long established clients who are ready willing and able cash purchasers.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

UNDISCLOSED ADDRESS, MAYFAIR, LONDON, W1

Three unmodernised buildings in prime Mayfair which have been in the same family ownership for over 40 years. The buildings were transacted on a completely off-market basis under a strict Non-Disclosure Agreement (hence no publication of the address). The properties were acquired to build a luxury ‘super home’ in excess of 12,000 sq.ft which will either be sold in the future or retained for rental income.

Allied property are particularly active in Central London in the super prime markets and have acquired many similar buildings for development into substantial family homes selling between £20M – £150M. We are always looking for similar opportunities for overseas family offices and clients cash funds available to transact on an immediate basis.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

LINSCOTT ROAD, HACKNEY, LONDON, E5

A residential investment building operating as an HMO (House in Multiple Occupation) with 13 units.

Allied Property have transacted over 1,100 HMO beds and have many family offices and other cash buyers to purchase and operate similar types of buildings for long term income.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

CANFIELD GARDENS, WEST HAMPSTEAD, LONDON, NW6

A residential and commercial A3 Freehold long-term investment sold on behalf of long-standing property client to substantial family trust to be held in their portfolio for future growth.

Allied Property acts for many family trusts and family offices who purchase dry investments such as this for long term income and rental growth purposes.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

FELLOWS ROAD, HAMPSTEAD, LONDON, NW3

A site with planning permission to build a luxury family home of approximately 8,000sq.ft. sold on behalf of a long-standing property client.

Although this property had a gross external area of 8,000sq.ft. only 1,000sq.ft. was above ground with 7,000sq.ft. proposed below ground. This was most certainly an unusual deal but we have many clients who are willing to purchase deals to develop the ‘unusual’ or the ‘quirky’..

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

GLOUCESTER PLACE, MARYLEBONE, LONDON, W1

A pair of residential freehold buildings with income and future development potential acquired on behalf of private property company.

Allied Property constantly search for properties with short to mid-term income and long term development potential on behalf of ready, willing and able cash buyers.

SOLD BY ALLIED

ASKING PRICE: £1.75M

CAMDEN HIGH STREET, CAMDEN TOWN, LONDON, NW1

A rare, unbroken Freehold building comprising an A3 unit on the ground floor let to Dominos Pizza together with a block of residential apartments in the upper parts in the heart of Camden offering ample asset management opportunities. The building was sold on behalf of an overseas family office client of Allied Property Investments. This is our 3rd deal with the same client in the space of 12 months.

In this instance we had three clients who lost out in the purchase of this asset and accordingly are seeking further similar buildings. We invite suggestions from property owners or mandated agents (who are paid by the seller) only.

SOLD BY ALLIED

ASKING PRICE: £1.5M

GLOUCESTER AVENUE, CAMDEN, LONDON, NW1

Allied Property sold an entire building in Primrose Hill comprising retail on the ground floor and residential upper parts. Our client will develop the airspace to develop an extra floor and then hold the building for long term income.

The client in question is looking to purchase further freehold shop and upper parts, for wealth preservation and has completed purchases via Allied Property in: Primrose Hill (x2), Hampstead Village (x3), Notting Hill (x4), Queens Park, Fulham and Belgravia.

SOLD BY ALLIED

ASKING PRICE: £1.2M

HIGH STREET, WATLINGTON, OXFORDSHIRE, OX49

Allied Property Investments sold a fully occupied business centre within a 17th Century listed building. The building featured 15 office suites with 2 retail units and parking to the rear. The opportunity was purchased with a high yield together with interesting asset management angles. Allied Property recommended that the building be disposed off in conjunction with one of our auction partners which the client accepted and which was successful.

We are continently working successfully with auction houses across the UK with whom we have close, long standing and strategic relationships with.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

HAMPSTEAD ROAD, CAMDEN, LONDON, NW1

Entire mixed-use development of 9 flats plus commercial forward purchased from developer prior to completion of the scheme on behalf of Hong Kong investment fund.

Allied Property have forward purchased over 1,000 units to Middle Eastern & Far Eastern clients. We are now looking across the UK to purchase entire developments within a 10 minute walk of a train station and between 6 – 36 months until practical completion with a minimum of 10 units and maximum 300 units.

SOLD BY ALLIED

ASKING PRICE: £3M

PLANTAGENET ROAD, BARNET, LONDON, EN5

An existing light industrial building measures c.12,375 sq.ft/ 1,150 sq.m sold by Allied Property. The building was on a site measuring 0.26 acres (0.105 Ha) which was sold to Timpson in conjunction with one of our commercial agency partners.

Allied Property work closely with many commercial, industrial and leisure agency partners in order to secure disposals for our clients. Allied Property pride ourselves in our out of the box thinking on behalf of our clients to achieve their desired outcome.

ACQUIRED FOR CLIENTS

ASKING PRICE: £9M

BOKA HOTEL, EARDLEY CRESCENT, LONDON, SW5

In this instance Allied Property managed to assist an auction house who were unable to produce an appropriate buyer for their client. Immediately after the auction our clients viewed the hotel and exchanged a week thereafter. The hotel had been in the same ownership for over 60 years.

Our client in this instance operates a number of Central London 3 and 4 star hotels as well as an extensive serviced accommodation portfolio. We are always looking for further stock on their behalf.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

WOODCHURCH ROAD, KILBURN, LONDON NW6

Double fronted and detached HMO building sold within 24 hours from inspection. The building has subsequently been held for long-term investment purposes by the purchaser.

Allied Property are extensively involved in the HMO and Hostel markets. We have acquired 100’s of buildings in these sectors, ranging from £1M buildings to portfolios close to £50M.

SOLD BY ALLIED

ASKING PRICE: £1.65M

TUESDAY MARKET PLACE, KING’S LYNN, NORFOLK, PE30

A pair of buildings sold on behalf of a client. One of the buildings will be developed into a Serviced-Office building and the other will be developed into 24 flats.

Allied Property have a number of regional buyers who are somewhat ‘off the beaten track’ and who are eagerly looking for opportunities in similar remote locations.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: £3.1M investment refinance

ST. JOHN’S WOOD, LONDON, NW8

£17M re-finance of senior funding and equity arranged on the development of 2 super-prime residences.

Allied Property regularly arranges cross-funding deals between clients to provide senior, junior, equity or mezz funding to facilitate other client’s purchases or developments.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

KING STREET, DARLINGTON, COUNTY DURHAM, DL3

A former NHS Hospital and Health Centre which was sold by Allied Property on behalf of an off-shore fund. The upper parts of the hospital had Permitted Development Rights granted for conversion of the building into 30 flats. The medical areas had undergone total refurbishment with interest in place from various medical users. Behind the hospital, there is also a large car park with the potential for our client to create a new building with some further flats.

This building was purchased by a very entrepreneurial client of Allied Property who often sees value where others fail to do so. Since completion of the sale, the purchaser has achieved planning for a further 18 units and effected a pre-let of the medical areas. Where other agents are often looking for ‘cheap deals’ as they are presented, Allied Property also focus on dealing with clients who are prepared to work hard to maximise the potential of buildings which are often overlooked by other buyers and their agents.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

BELSIZE PARK GARDENS, BELSIZE PARK, LONDON, NW3

A former private health club which was available in the market place for a number of months via ‘the big agents’. There were previously a couple of failed attempts to do the deal. Allied managed to acquire the building and exchange contracts within 5 days of the viewing. The building was acquired on a completely unconditional basis with vacant possession. Various schemes are currently under consideration in terms of repositioning the use in the future.

Allied Property’s client in this instance is constantly looking for deliverable and valuable planning gain/repositioning opportunities across the UK. The client will consider both land and buildings with no minimum or maximum value restrictions. They are able to transact immediately with cash funds without the need for income or planning in place.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

PEMBRIDGE ROAD, NOTTING HILL, LONDON, W11

This was an entire Freehold building comprising unmodernised self-contained apartments. The property is located in prime Notting Hill Gate and will be retained by our client for long-term rental income and potential increase in massing via the addition of an extra floor.

This building was purchased by a well established investment client of Allied who are extremely active in the Bayswater, Notting Hill and South Kensington markets. The client in this instance has a rolling facility of £50-£60m to purchase similar assets in these locations only. They are predominantly looking for Residential, Commercial or Mixed-Use buildings with asset management opportunities to create income.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

KINGS ROAD, CHELSEA, LONDON, SW3

Freehold A3 investment acquired for long-term investment.

Allied Property acts for many family trusts and family offices who purchase dry investments such as this for long term income and rental growth purposes.

SOLD BY ALLIED

ASKING PRICE: £3.5M

EUSTON ROAD, MORECAMBE, LANCASHIRE, LA4

Mixed-Use investment sold by Allied Property on behalf a UK REIT within 1 week of receiving mandate. The deal included the sale of a 70 bedroom Travelodge Hotel together with a Ground Floor gym space let to a well-known operator. This deal will be held for long-term investment purposes and further asset management opportunities.

Allied Property have a number of private and institutional clients looking for long-term investments and asset management opportunities.

SOLD BY ALLIED

ASKING PRICE: £1.45M

HIGH STREET, STRATFORD, LONDON, E15

Former post-office building held in the same family ownership for over 35 years. The Vendor had originally instructed local agents to sell the building with no success. Allied Property were able to source a purchaser who exchanged contracts within 2 weeks from the date of instruction. In the end, Allied Property had two purchasers fighting for the deal and who were both willing to exchange.

Our dedicated team work hands-on with clients. We have long-term relationships and an inherent understanding of their portfolios and requirements. Our focus and our drive often allow us to succeed where other agents fail.

SOLD BY ALLIED

ASKING PRICE: £1.6M

WOODHOUSE ROAD, NORTH FINCHLEY, LONDON, N12

Site and building sold within 4 working days from mandate. This transaction was sold with planning permission to develop a 3-storey building with 8 x 2 bedroom flats. The original building was a former Salmon packing factory.

Allied Property often transact deals and effect Exchange of Contracts in under 5 days. We work on the ethos that one should capitalise when there is a willing buyer and a willing seller.

SOLD BY ALLIED

ASKING PRICE: £2.2M

CHAPEL MARKET, ISLINGTON, LONDON, N1

Freehold shop and upper parts acquired on behalf of a family trust for long term income. The ground floor commercial is let to Ladbrokes with residential flats above. It is worth noting that this investment was acquired off market (prior to marketing) and contracts were exchanged within 3 working days of the inspection with completion 2 weeks thereafter.

Allied Property act on behalf of a number of family trusts who purchase income with a long term view. We are always looking to acquire similar types of buildings for ready, willing and able clients with cash funds available and who are willing to effect exchange of contracts within a matter of days.

ACQUIRED FOR CLIENTS

ASKING PRICE: £4.65M

ELWICK ROAD, ASHFORD, KENT, TN23

A vacant office building acquired for clients with Permitted-Development Rights (PDR) in place to convert to residential. The acquiring client eventually achieved planning permission for further residential units (by adding two new build floors) and developed out the entire scheme. Some of the units were sold and some were retained by the family for long-term rental.

Allied Property are constantly on the lookout for buildings with or without Planning Permission and or Permitted Development on behalf of ready, willing and able cash purchasers.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

MORTLAKE HIGH STREET, RICHMOND, LONDON, SE14

Riverside office building with Permitted Development Rights in place for 16 apartments.

We are always looking to purchase sites, land and buildings with and without planning permission / PD for development on behalf of long established ready, willing and able cash purchasers.

SOLD BY ALLIED

ASKING PRICE: OIEO £500k

FACTORY LANE, MANNINGTREE, ESSEX, CO11

Former industrial site sold currently featuring a 3 storey derelict building and associated parking with permitted development in place for 21 residential units. The site is located 1 mile from Manningtree Station which is 1 hour from Liverpool Street.

Despite being marketed by a number of agents and failing to sell at auction Allied Property managed to introduce a ready, willing and able cash purchaser to buy this site and successfully complete on the deal within 1 month. With our focused hands on approach we are often able to succeed where other agents fail. Allied deal only with long standing clients who are proven performers with ample cash funds, we do not deal with other agents or third party introducers.

SOLD BY ALLIED

ASKING PRICE: £1.5M

UPPER TACHBROOK, PIMLICO, LONDON, SW1

Freehold retail unit with residential upper parts sold to a charity client of Allied Property prior to marketing. The purchaser exchanged contracts within 48 hours of inspection and completed 3 weeks later. The building has tangible opportunity to add an extra floor and to extend to the rear to increase both residential and retail areas. Once developed the building will be held by the charity for long term investment.

Allied property act for a number of charities, not for profit developers and housing associations. We are constantly looking for buildings with development potential on behalf of these clients who have reasonable profit and yield aspirations and who take long term views on the market.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

GREAT PORTLAND STREET, MARYLEBONE, LONDON, W1

Upper parts to mixed-use development acquired for investment on behalf of Israeli client.

Allied Property advise and act for many family offices who acquire buildings for long term income and growth in residual values. We have clients who operate portfolios of between 20,000 – 68,000 units.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

TRAFALGAR ROAD, GREENWICH, LONDON, SE10

Substantial corner building part-let to Ladbrokes Plc and planning permission granted for the re-development of the upper parts to 6 self-contained units with further planning potential for another residential unit acquired for family office.

Allied Property constantly search for properties with short to mid-term income and long term development potential on behalf of long-established clients who are ready, willing and able cash buyers.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: £780K

LONDON, NW6

£780K bridging finance arranged (and delivered within 48 hours) to remove existing lender. The property is currently being refurbished for future part-sale and part-retention.

Allied Property regularly arranges cross-funding deals between clients to provide senior, junior, equity or mezz funding to facilitate other client’s purchases or developments.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

LIVERPOOL ROAD, ISLINGTON, LONDON, N1

8,500sq.ft. office building sold for conversion into 8 residential units via permitted development rights.

Allied have acquired many buildings for permitted development and continue to seek further opportunities in this sector.

ACQUIRED FOR CLIENTS

ASKING PRICE: Undisclosed

SANDY’S ROW, SHOREDITCH, LONDON, E1

Mixed-use building featuring residential and B1 offices acquired for long-term investment sold to Swedish investment fund.

Allied Property acts for many family trusts and family offices who purchase dry investments such as this for long term income and rental growth purposes.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

HARDWICKS SQUARE, WANDSWORTH, LONDON, SW18

Commercial upper parts to mixed-use building acquired with permitted development rights to convert to residential.

Allied have acquired many buildings for permitted development and continue to seek further opportunities in this sector.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

FINCHLEY ROAD, WEST HAMPSTEAD, LONDON, NW3

Site comprising 5 family homes and land to front and rear sold with planning permission for luxury, new build residential scheme of 13 flats sold to UK based property company.

We are always looking to purchase sites, land and buildings with and without planning permission for development on behalf of long established clients who are ready, willing and able cash purchasers.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: £15.6M

STRATFORD, LONDON, E15

Cross-client funding deal raising £15,600,000 to facilitate development of substantial residential scheme.

Allied Property regularly arranges cross-funding deals between clients to provide senior, junior, equity or mezz funding to facilitate other client’s purchases or developments.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

ST RADIGUNDS ROAD, DOVER, KENT, CT17

The entire block was sold at a bulk discount to open market values to a family office who retain the property for rental income.

Allied Property are currently transacting on many other forward/bulk purchases in the South East. We are constantly searching for more ‘deliverable and valuable’ unbroken freehold blocks. Our client is able to transact on forward/ bulk purchases between 20-100 units on an immediate basis across the UK.

SOLD BY ALLIED

ASKING PRICE: £3.75M

BROADWAY, BEXLEYHEATH, KENT, DA6

Sale of Government offices occupied by the Secretary of the State for Work and Pensions. The building was eventually granted Permitted Development for conversion into 57 flats. In this instance our client was a European Family Office Fund who instructed Allied after failing to sell with one local and one global agent. Allied Property were able to source a purchaser who exchanged contracts within 48 hours.

Allied Property are constantly searching for deliverable and valuable property investment and development opportunities on behalf of U.K. and Overseas, private and institutional clients with whom we have long-standing relationships.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

BEAVOR LANE, HAMMERSMITH, LONDON, W6

Land and former office building sold subject to planning for residential scheme comprising 9 houses and 8,000sq.ft. of B1 space.

Office building acquired without planning permission on an unconditional basis. The client has subsequently achieved permitted development for a residential scheme which they are building out. Allied have acquired many buildings for permitted development and continue to seek further opportunities in this sector.

SOLD BY ALLIED

ASKING PRICE: Undisclosed

CLARENDON ROAD, WATFORD, HERTFORDSHIRE, WD17

City centre mixed-use building sold with planning permission for permitted development comprising 49 units plus retail.

Allied Property constantly search for properties with short to mid-term income and long term development potential on behalf of ready, willing and able cash buyers.

SOLD BY ALLIED

ASKING PRICE: £1.425M

THE HEADLANDS, HARTLEPOOL, COUNTY DURHAM, TS24

An unbroken block of 32 self-contained flats on ‘Hartlepool’s Headland’ with sea views located 10 minutes from Hartlepool Town Centre sold by Allied Property. In this instance the client in question already had two abortive sales and a sale that had previously exchanged without completing. Allied Property introduced a client who exchanged and completed simultaneously with cash reserves.

Allied Property are extremely experienced in nurturing and working with both clients and their solicitors who can be relied upon to succeed in transaction terms where others have already failed to do so.

FUNDING ARRANGED BY ALLIED

ASKING PRICE: £975K

MILE END, LONDON, E3

Cross-client funding deal raising £975,000 to facilitate an unconditional purchase of a site with future plans to develop a mixed-use residential and retail scheme.

Allied Property regularly arranges cross-funding deals between clients to provide senior, junior, equity or mezz funding to facilitate other client’s purchases or developments.

© 2025 Allied Property Investments | Privacy Policy